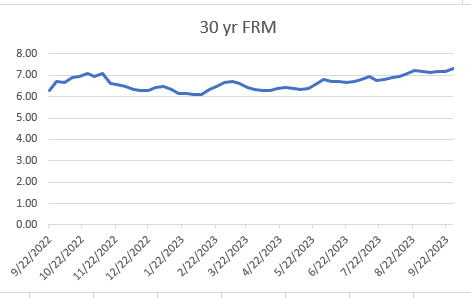

With mortgage rates at a 23-year high (7.31% for a 30-yr fixed rate mortgage as of 9/28/2023), Freddie Mac indicated more and more buyers and sellers say they are holding out for better circumstances.

Lenders and industry insiders have diverging expectations on which direction rates may be heading in the wake of the Federal Reserve’s decisions to raise the federal funds rate seven times in 2022 and four more times so far this year. Early in 2023, economists predicted gradual declines throughout the year, but in fact rates have trended higher.

Economists at Wells Fargo & Co. expect rate cuts in 2024 totaling 2.25 percentage points in the federal funds rate. In its January outlook Wells Fargo predicted rates would average 6.1%, but amended it to 6.7% in August. The bank’s forecasters think rates will fall below 6% in the second quarter of 2024.

Fannie Mae pegged the 30-year fixed rate at 6.8% at its August Housing Forecast, with rates dipping to 6.7% by year-end. It does not expect rates to fall below 6% until 2025.

The Mortgage Bankers Association also revised its expectations, predicting the rate will stay above 6% until early 2024. They anticipate improving conditions next year, with rates falling to 5% in the fourth quarter.

In its August Economic Outlook, the National Association of REALTORS® said it expects mortgage rates to fall to 6.3% by year-end and decline further to 6% in 2024.

Taylor Marr, deputy chief economist at Redfin, said it is unlikely mortgage rates would drop below 6% before the end of the year, “and most homeowners wouldn’t be motivated to sell unless rates dropped further.” In a recent study, Redfin found that 92% of homeowners with a mortgage have a rate below 6%, and nearly a quarter (24%) have a rate below 3%.

In March, the team at John Burns Research & Consulting found 5.5% was “the magic mortgage rate, the tipping point beyond which most consumers say they would not buy a home.” More recently, those attitudes have not changed, despite six months of rates hovering between 6.5% and 7.5%.

Burns cites three reasons why the 5.5% rate has such a hold on consumers:

- Consumers are mentally anchored to low rates, noting mortgage rates stayed below 5% for 12 consecutive years when most of the borrowers in their New Home Trends Institute survey bought or refinanced. The vast majority – 90% – of current borrowers have rates below 5.5%.

- Consumers cannot afford a higher rate. “Affordability has never been worse,” the researchers wrote, adding it’s why builders are finding success with rate buydowns.

- Consumers expect rates to fall. Some 88% believe rates will drop below 5.5% at some point in the next five years.

“For buyers who are not in a hurry, the fall and winter months could bring better values and a less competitive environment to find the right home,” said George Ratiu, chief economist at Keeping Current Matters, a real estate market insights company. His comments were made in an interview with U.S. News.

In late July, NAR chief economist Lawrence Yun said, “Given the ongoing job additions, any meaningful decline in mortgage rates could lead to a rush of buyers later in the year and into next.”

S&A | Home Search

Our Opinion:

Let's get real for a moment. Rising interest rates have got a lot of potential buyers pumping the brakes, and that's understandable. But here's the deal: this might actually be a fantastic time for you to dive in.

As higher rates are creating a sort of "buyer's chill," making many hold off on purchasing, this slowdown gives you a unique advantage. With fewer buyers in the game, sellers are becoming more motivated, potentially offering better prices or additional perks. In simpler terms, you've got some solid negotiating power right now.

Now, picture a future where interest rates eventually drop. When that happens, all those buyers who've been sitting it out will rush back in. The housing market will turn back into a bidding wars overnight. Prices will likely skyrocket due to the sudden surge in demand, and you'll find yourself competing with the crowds once again.

So, our take? If you're financially prepared and you come across a property that ticks most of your boxes, consider taking the plunge now. The numbers might look daunting today, but seizing an opportunity in a less competitive market could set you up for significant gains when the inevitable market rebound occurs.

When interest rates drop and pent-up demand comes flooding back, the landscape will shift dramatically. By acting now, you're not just beating the rush—you're setting yourself up for a future win. It's all about playing the long game, and in our view, the time to make your move might just be now.

As your local real estate experts, we're here to guide you through the buying or selling process. Interested in learning more? Give us a call today at 206-915-7653 (SOLD) or visit our website at www.shaneandanne.com.